Tend is for people with full lives who need clear visibility of their household finances without the burden of traditional budgeting.

Managing money needs to be

Radically Simpler

The budget app with only 5 categories.

We got tired of maintaining a giant list of categories in the other budget apps, so we thought hard and discovered the only 5 you'll ever need.

Tend uses the Kakeibo

budgeting method

developed by Japanese housewives in 1904.

It works like this:

-

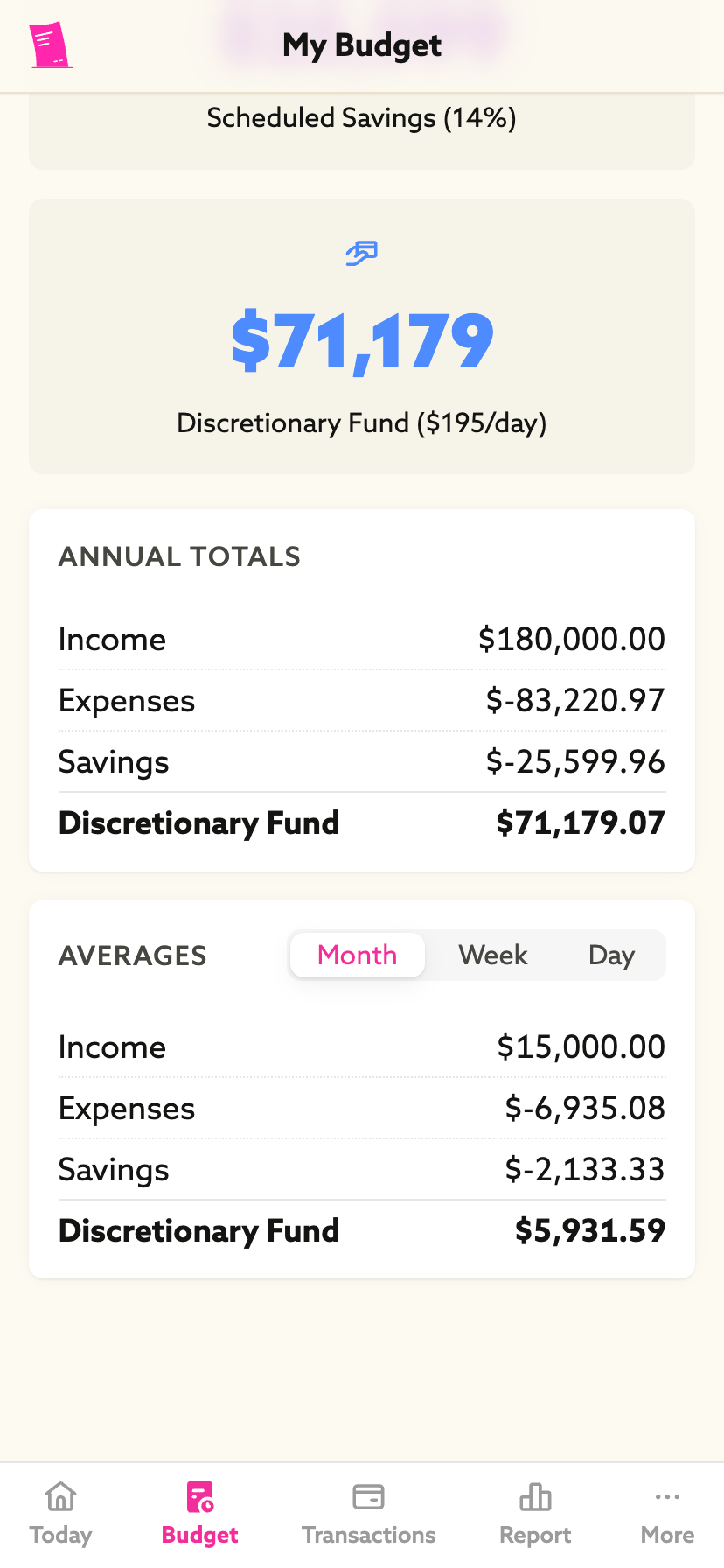

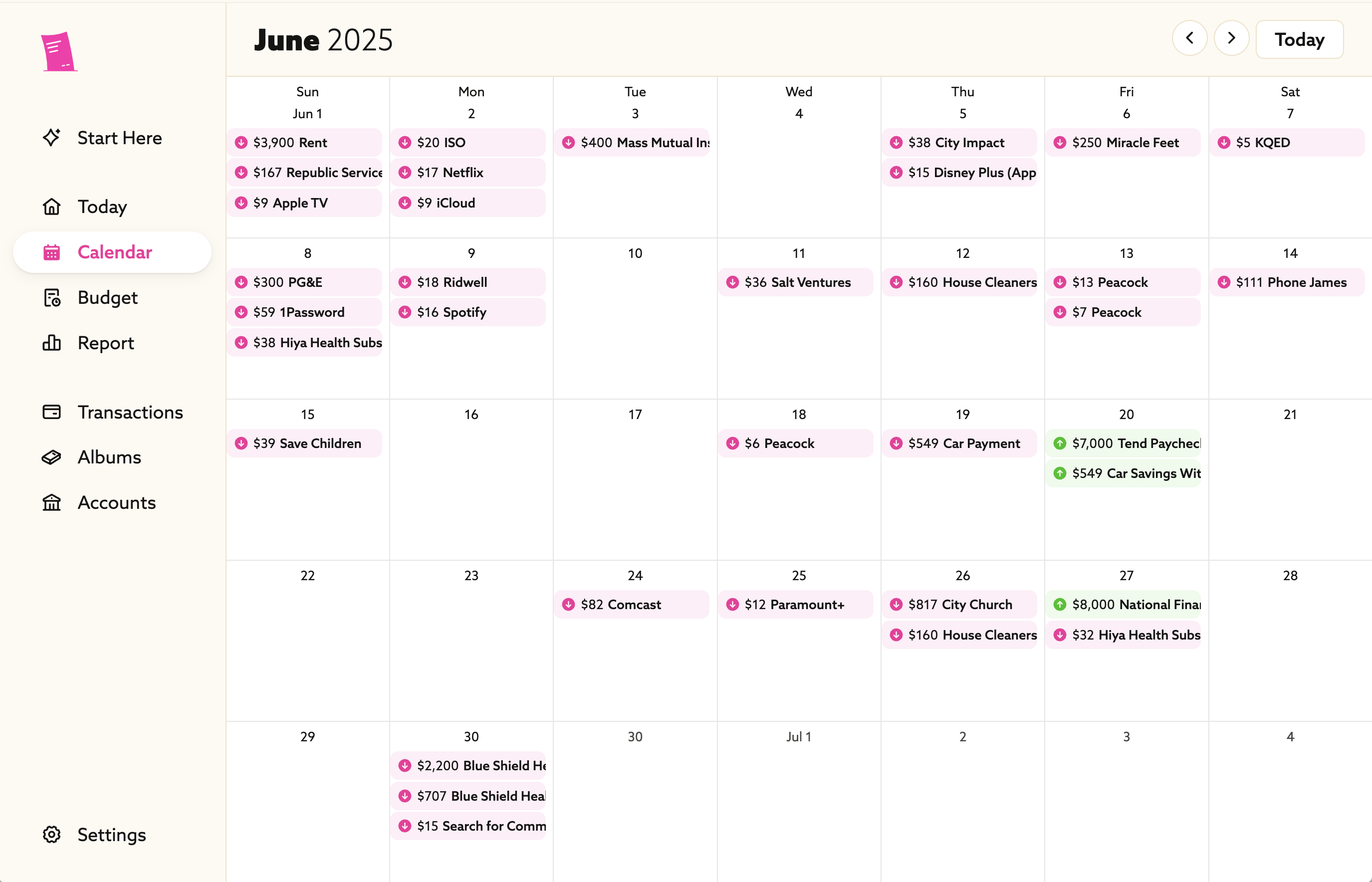

1. Calendar all your income sources for the year.

-

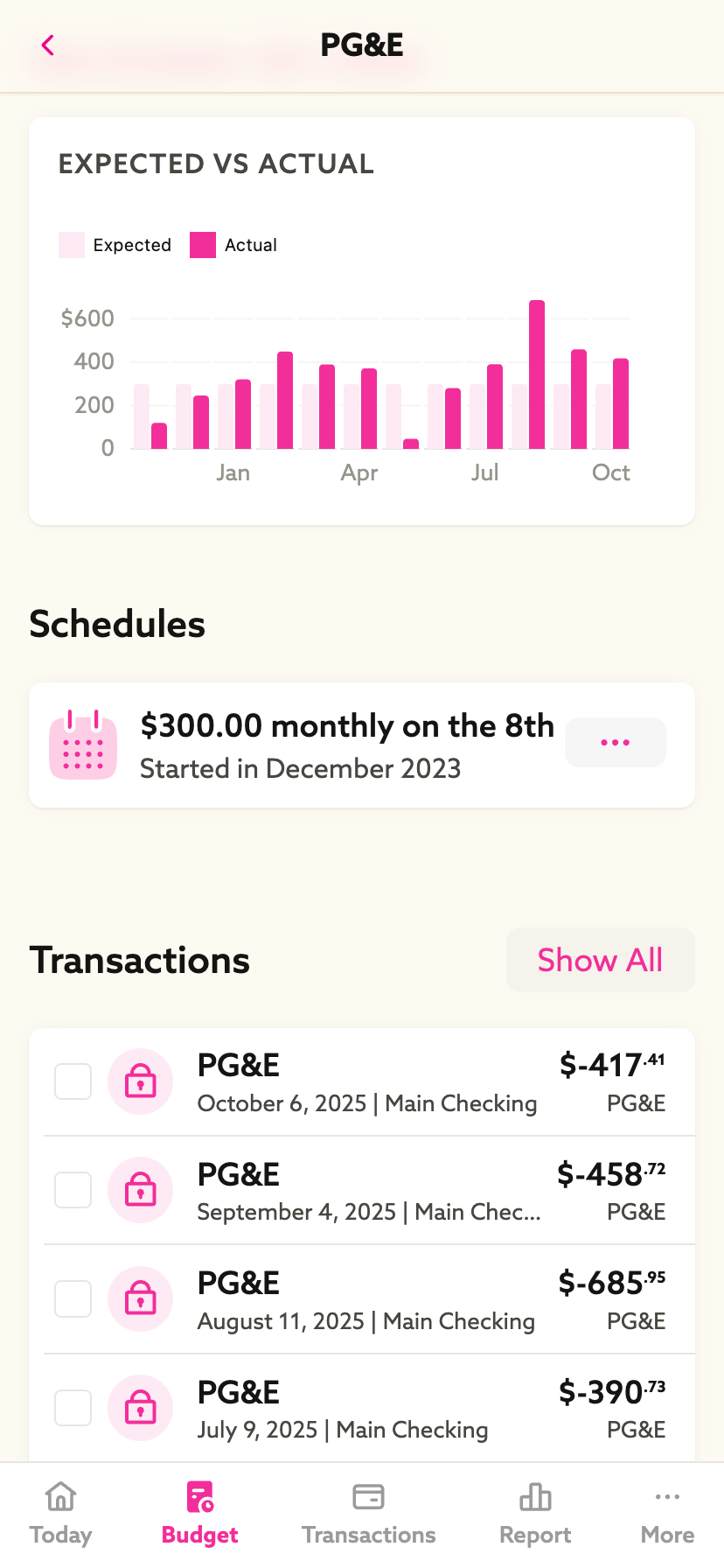

2. Calendar all your fixed expenses for the year.

-

3. Calendar what you will save for special things for the year.

-

4. See what's left for discretionary expenses.

Don't lose sight of the big picture.

A single, true limit will always be more effective than dozens of arbitrary ones.

This Week's Discretionary Spending

| Allowance | $980.00 |

| Spent | $350.21 |

| Result | $629.79 |

A new week starts Monday

The discretionary allowance is the amount you can safely spend and still have your fixed expenses covered.

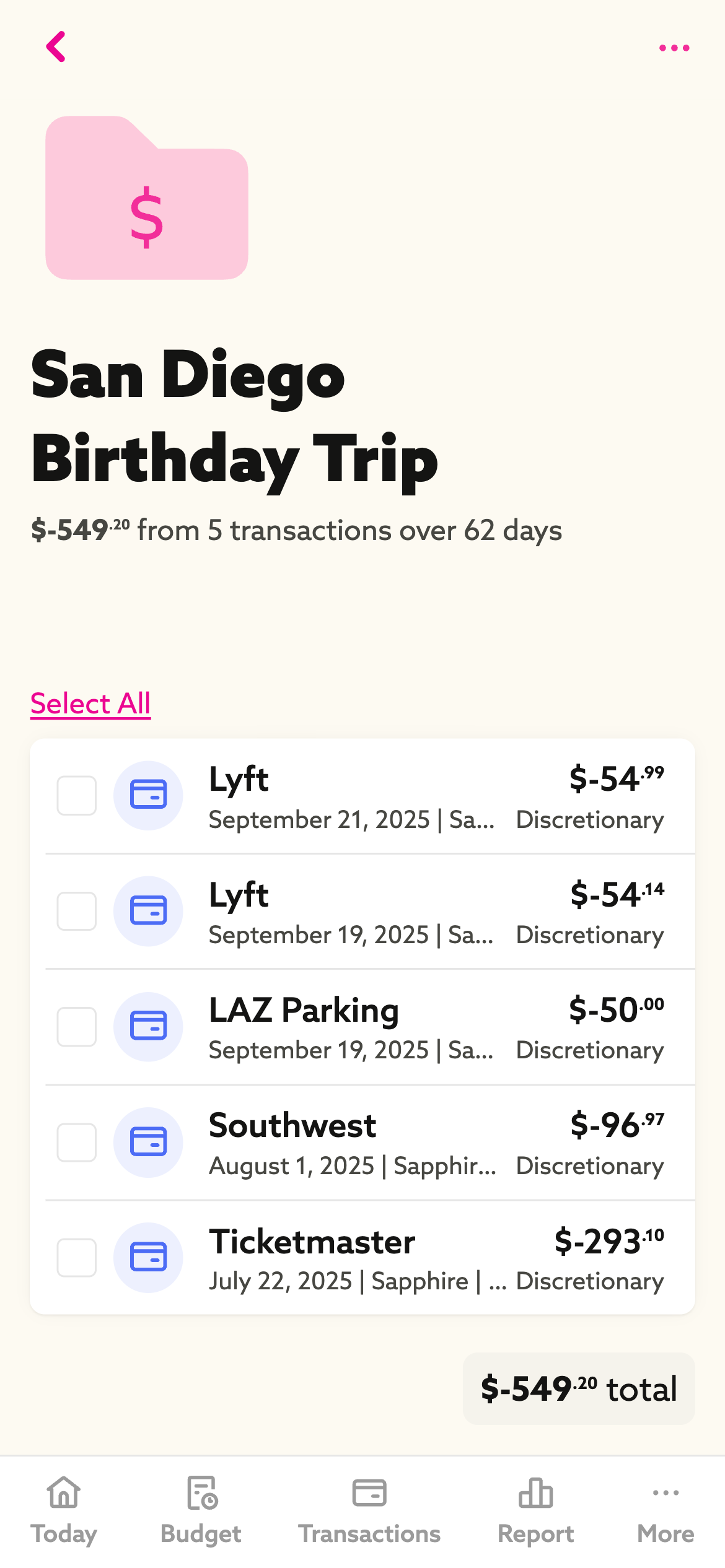

How much did that trip cost?

Create a transaction album to hold all the expenses related an event.

Easily track the total cost of trips, home projects, or parties.

Get started in 7 minutes.

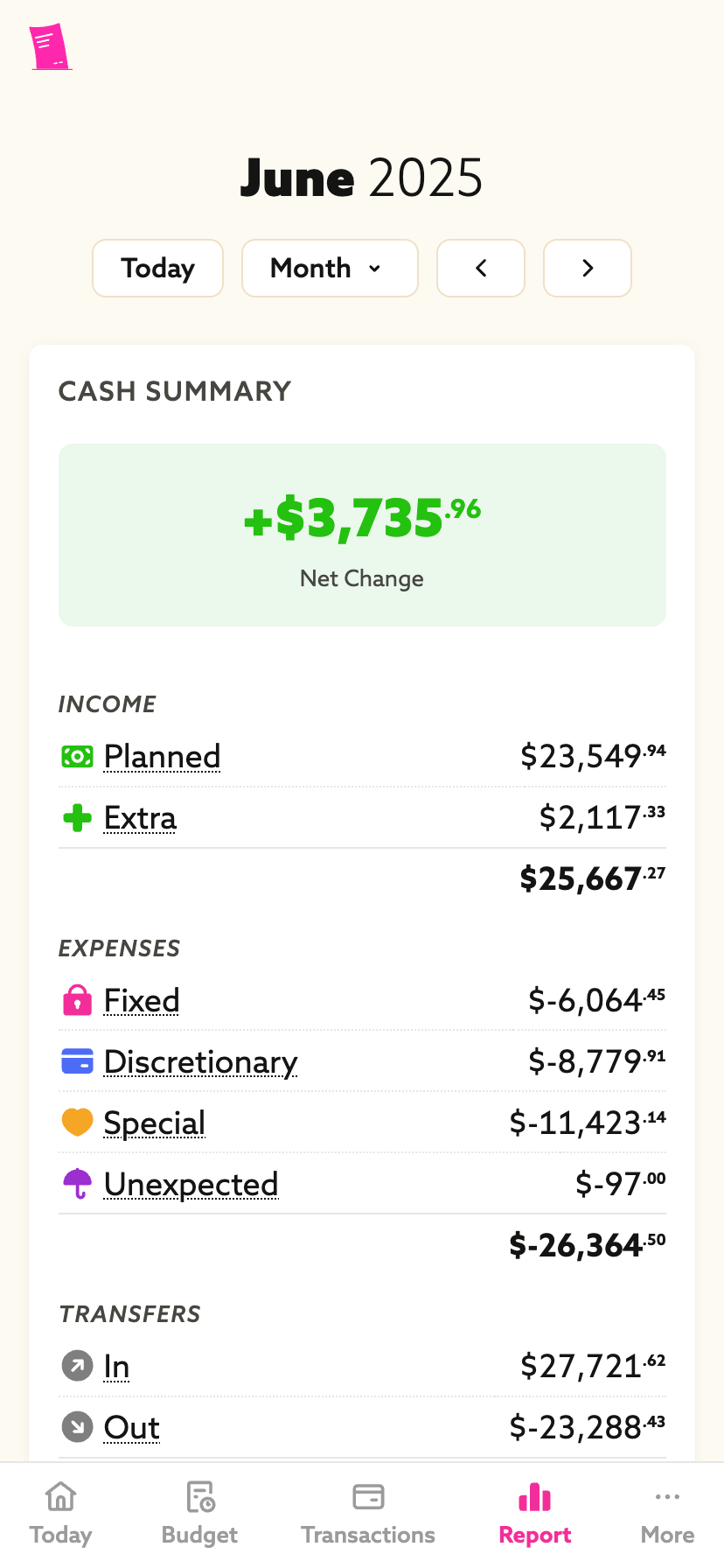

What's a normal month?

There's no such thing.

Other apps will make you hack your expenses into a monthly system. Tend embraces the ebbs and flows of real-life.

Fixed Expense Calendar

You will spend $3,488 on fixed expenses this month.

This is $412 more than your average monthly amount of $3,076.

Show Next 12 Months

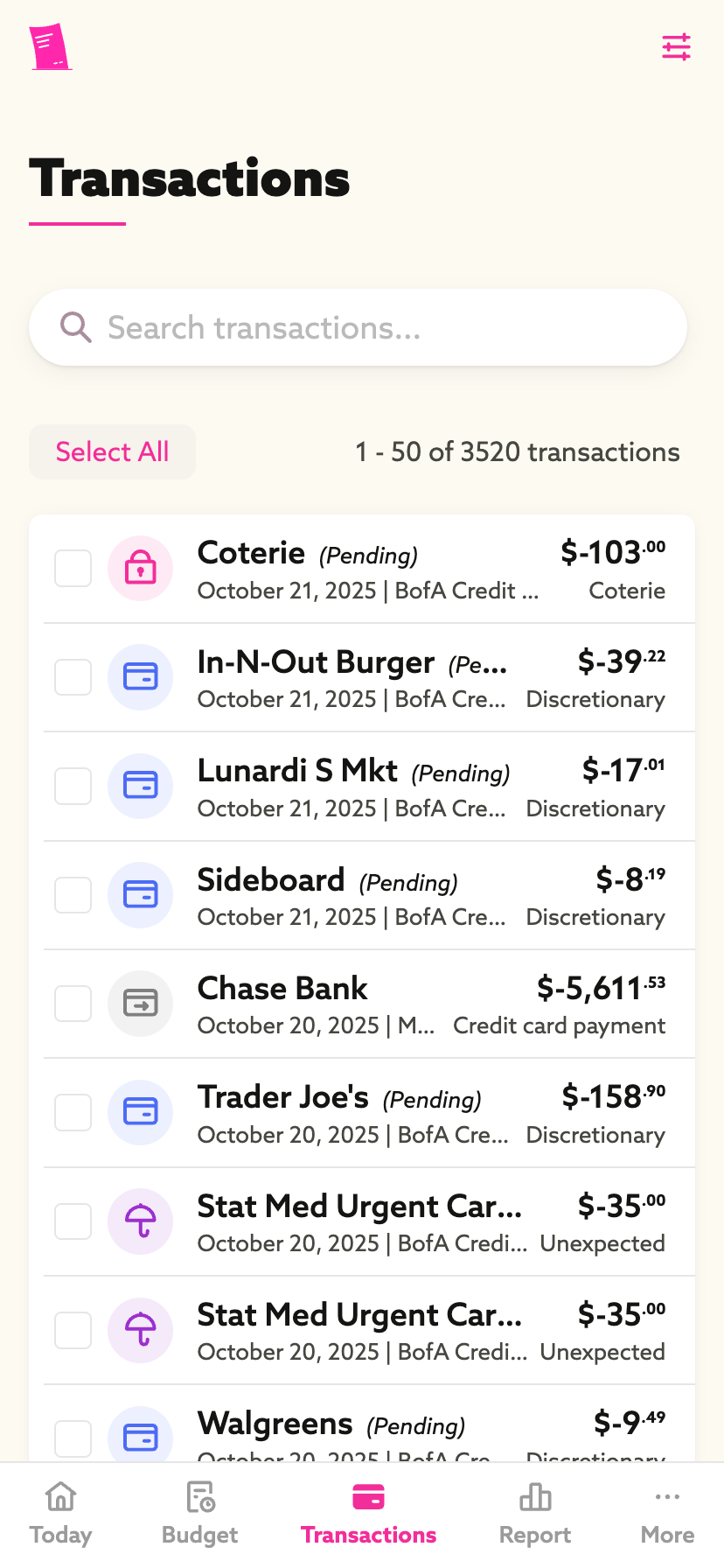

Humans are notoriously bad at predicting the future.

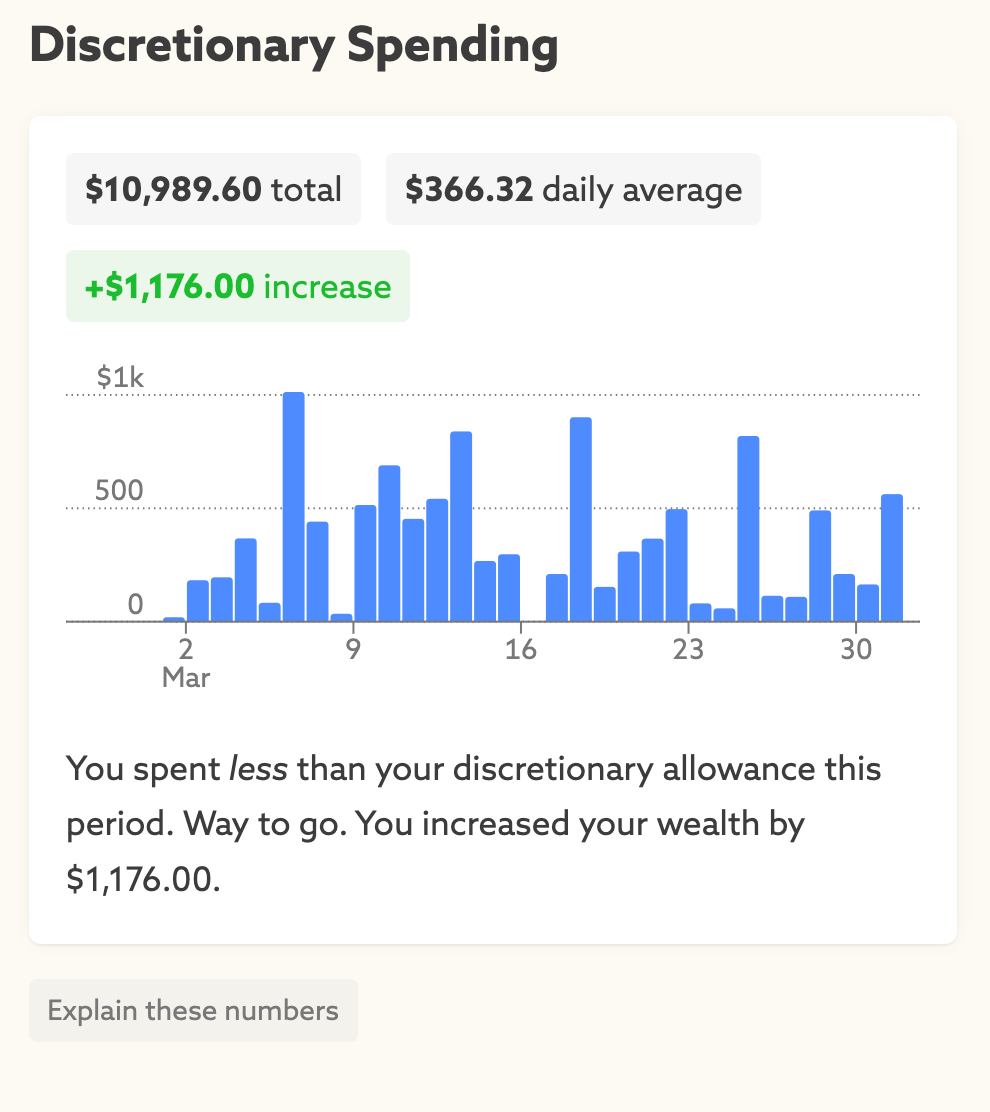

Tend will not make you budget (a.k.a. "guess") the places where you'll spend your discretionary money like other apps do — but it will show where you spent it.

Your discretionary spending is always analyzed separately from your fixed expenses.

Top Discretionary Merchants

| Merchant | Total |

|---|---|

| Amazon | $507.21 |

| Nordstrom | $200.77 |

| Thrive Market | $169.59 |

| Trader Joe's | $93.43 |

| Matching Half | $76.94 |

Reflect on the past day, week, month, and year to check if your spending is aligned with what's important to you.

And more...

- Simulate big life changes by creating "What Ifs" and compare them with your current budget plan. (coming soon)

- Be notified when a fixed expense costs more than you expected. (coming soon)

- Add tags to transactions to track the types of transactions you care about. (coming soon)

- Upload documents (like invoices or receipts) to a transaction keeping all your financial docs in one place. (coming soon)

- Add notes to clarify the reason behind a purchase. (coming soon)

- Flag transactions that you want to investigate later. (coming soon)