Track Your Money With Only 4 Categories

The best budget is the one you stick to. Tend is seriously simplified money management for your household.

"Finally, a budget that doesn't feel like a second job"

"I've religiously tracked my family's spend for close to 10 years with YNAB. But now with children and a strong financial situation, it's certainly feeling more like a second job. I really resonate with your thinking about over-the-top tracking."

"It's what I've been searching for for ages"

"I was about to resign myself to building my own solution but very happy to see someone else has shipped something better."

"I struggle to keep track with other apps"

"YNAB has a nice interface, but I struggle to keep track of fixed expenses and what I have left to spend. I like Tend because of the scheduled income and expenses and how it calculates discretionary spending."

How it works

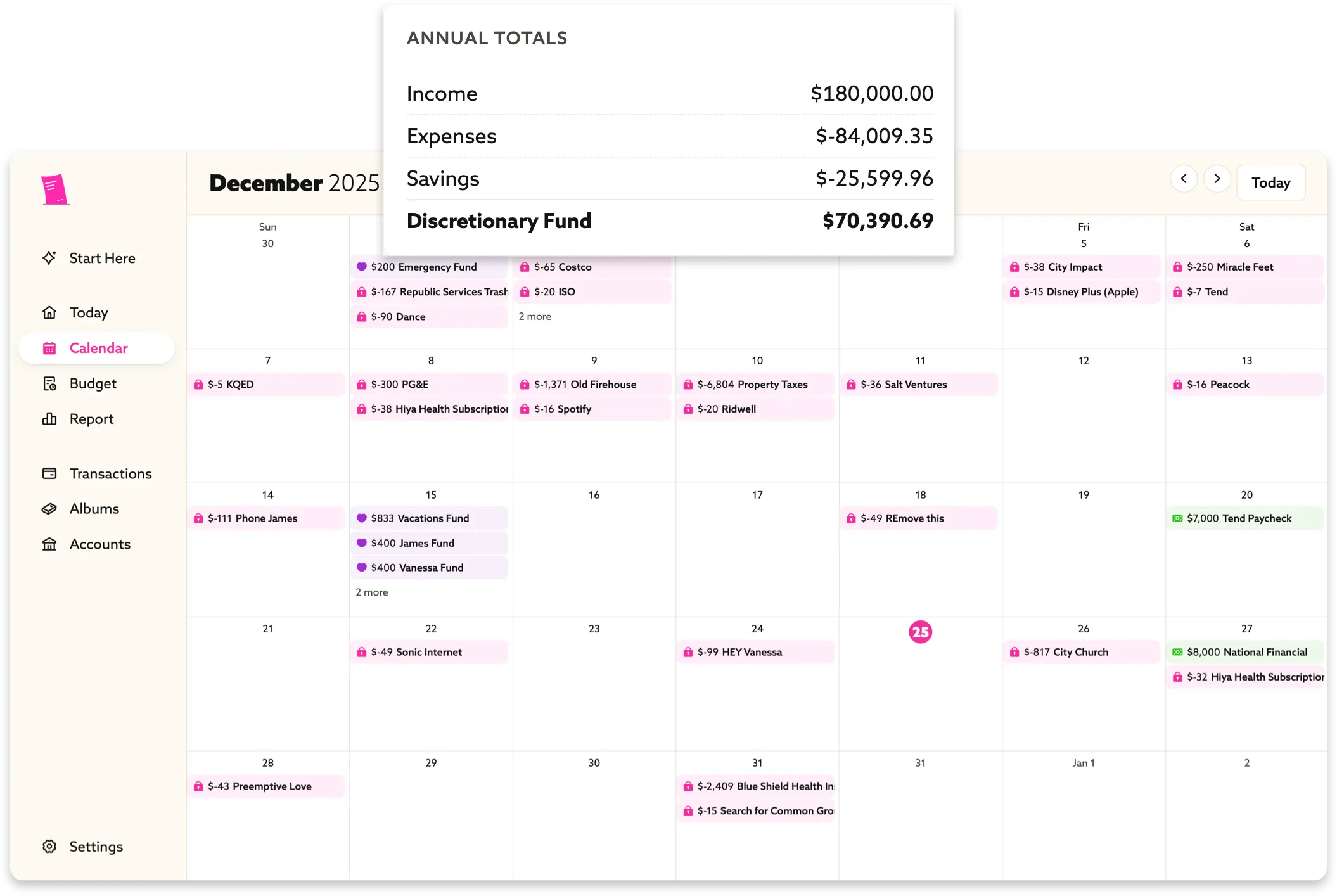

Calendar

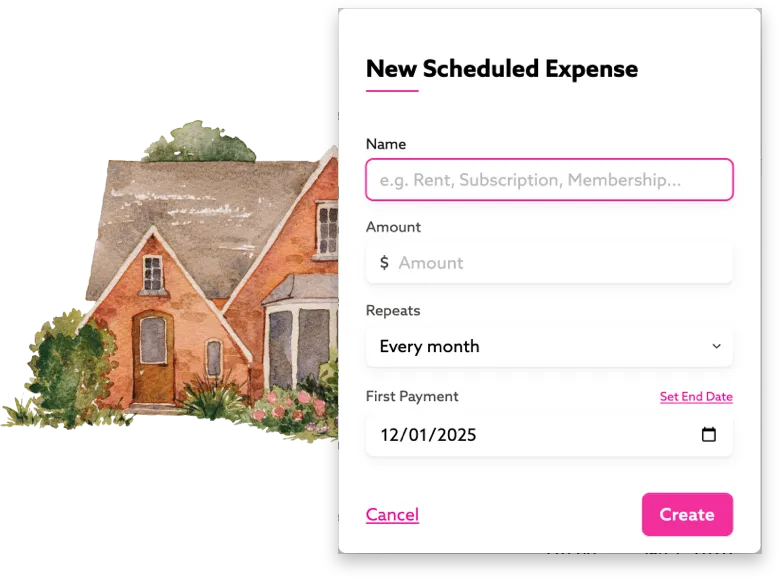

Schedule your commitments

Rent, insurance, subscriptions, automatic savings - these are known, predictable, required expenses that get scheduled on your calendar. Know exactly how much money is committed to these fixed expenses and see whats left.

Plan

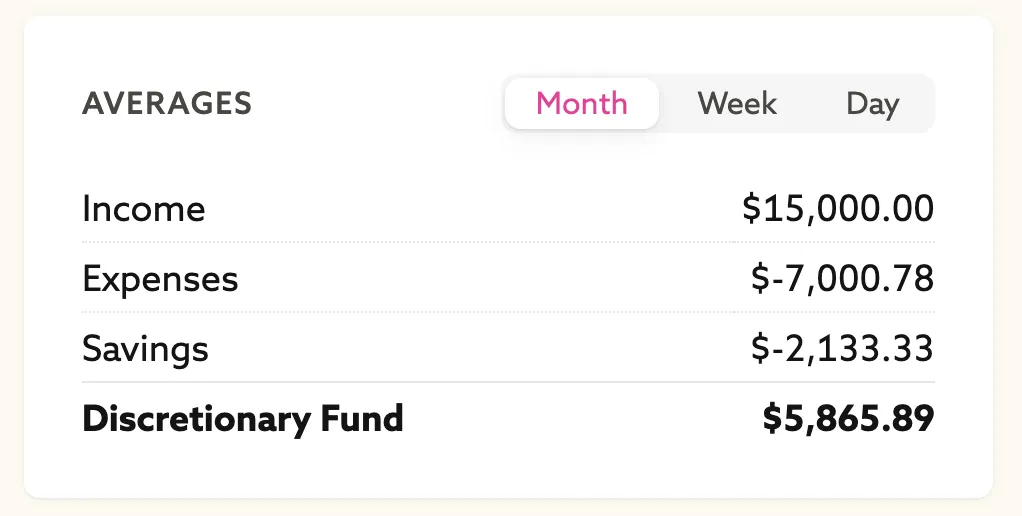

Calculate what's left

After your fixed income & expenses are accounted for, Tend will calculate whats left for discretionary purchases. This is the money you can control with your day-to-day choices. Average this out and get a simple target for your monthly and weekly spending.

Spend

Only 4 categories. Not 40.

Connect your accounts to track your spending using only 4 categories based on your level of control over the purchase, not the "type of thing" it was. Radically simple categories like this makes reviewing transactions fast, fun, and sustainable. Never split a transaction again.

Simplify

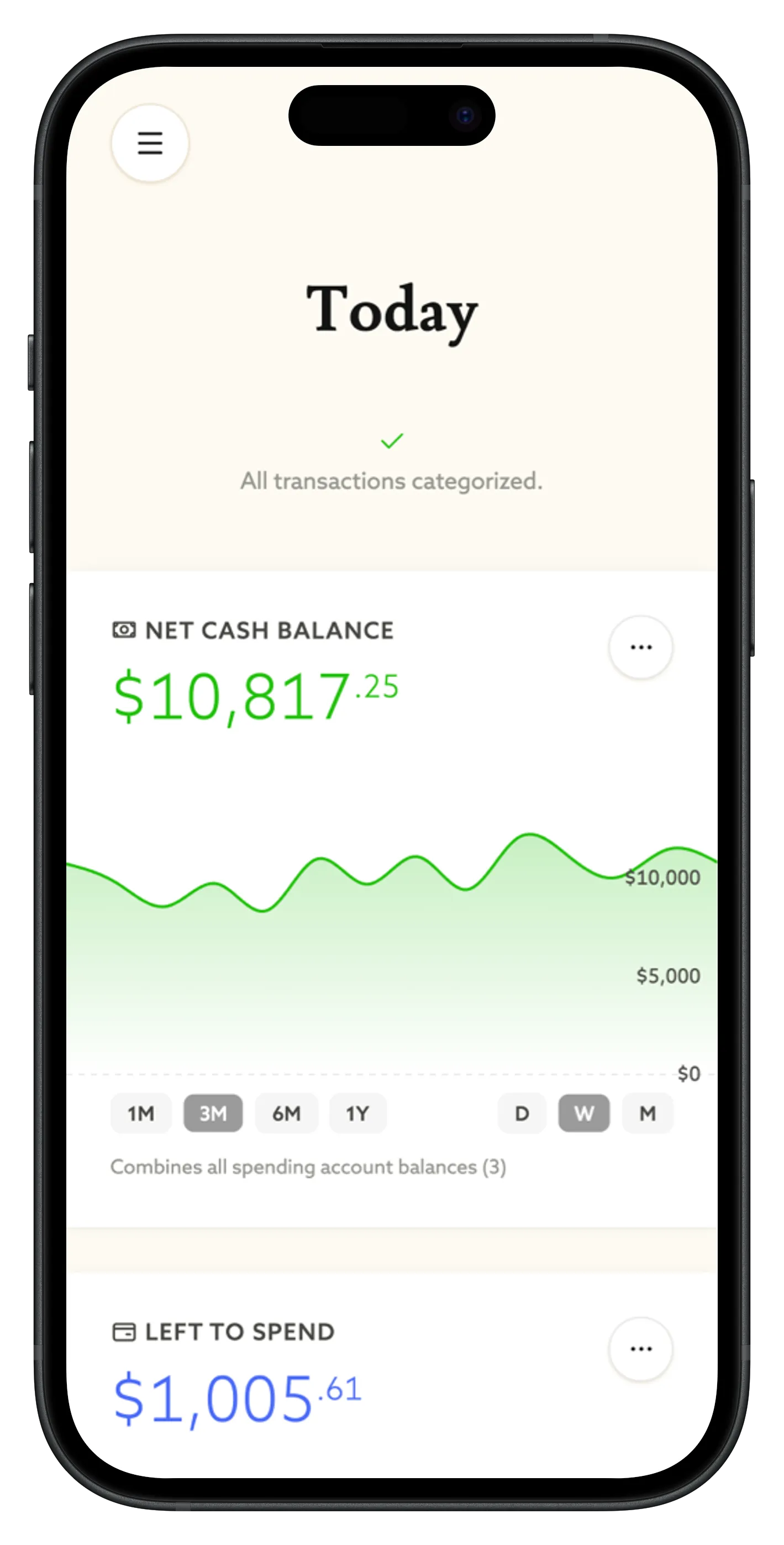

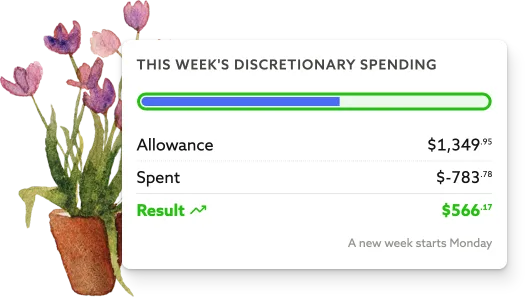

Track one number

Your weekly discretionary target is the only number you track. One progress bar. Updated in real-time as you spend.

You tried the other apps.

YNAB, Monarch, Copilot, EveryDollar… they all look like this:

They missed the point.

You don't care what you spent on fitness. You simply need to know that you are spending less than you make.

Goodbye Zero-Based Budgets

Why Category Budgeting Fails

Category Confusion

Should TV subscriptions be separate or grouped as "Entertainment"?

Creating categories is a subjective, potentially endless pursuit. Your organized feeling vanishes as you wonder if you have too many, or if you are missing something critical. Besides, life is too short to be "splitting" transactions when you buy food and clothes from the same store.

Maintenance Nightmare

"Groceries" is over. Should I move money from "Home Repair"?

Constantly moving money around to cover "overspending" distracts from seeing what you truly have. Not to mention all the time it takes to maintain. Allocate, categorize, move money, fix outdated rules, repeat. Your budget app is now your second job.

Impossible Task

How much should I set aside for "Cleaning Supplies"?

Humans are terrible at predicting the future. Guessing how every dollar will be spent in each of 40+ categories is unsustainable and guaranteed to fail. Prices change. Priorities change. The best budget app is the one you can stick to.

Introducing...

Calendar-Based Budgeting

1) Schedule what's fixed on your calendar.

2) Track what's left with a single progress bar.

Everything you need. Nothing you don't.

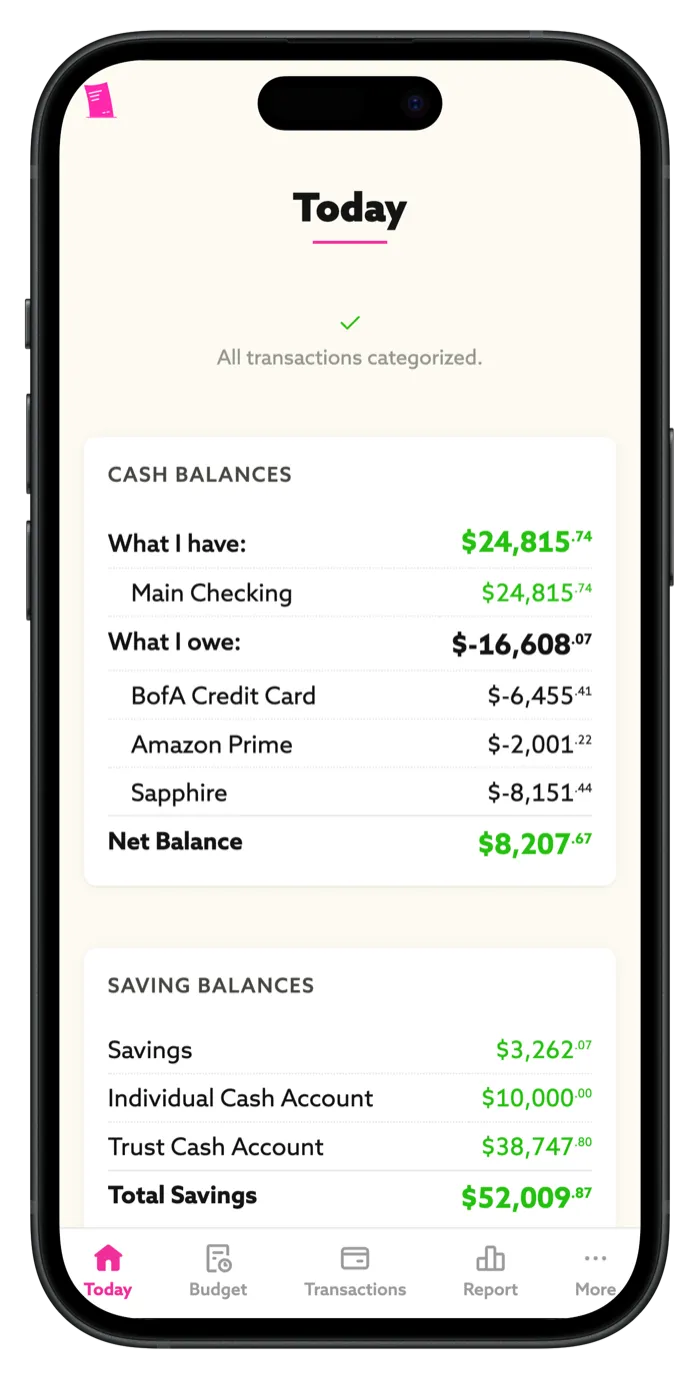

All your accounts in one place

See balances across all your bank accounts. Track your net cash balance to make sure you always have enough on hand.

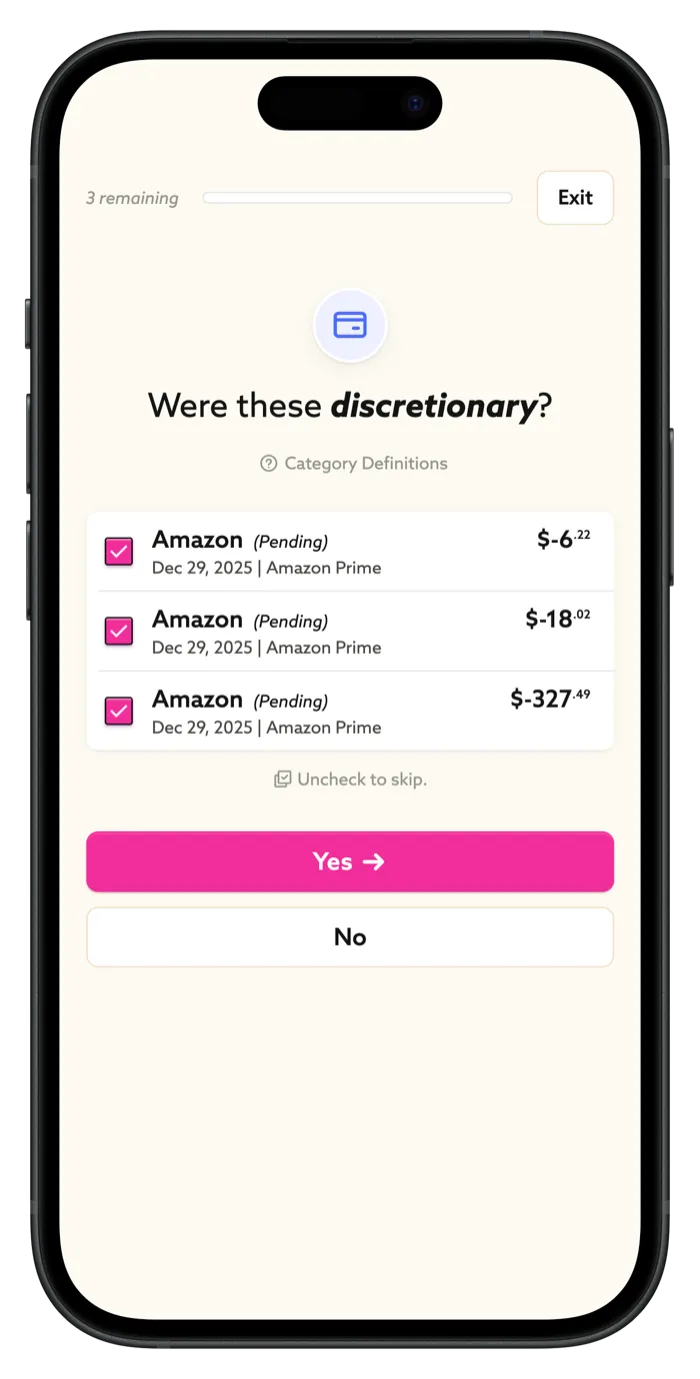

Intelligent Transaction Review

Categorize transactions in bulk using only 4 categories. Tend groups related transactions together so you can review quickly and get back to your life.

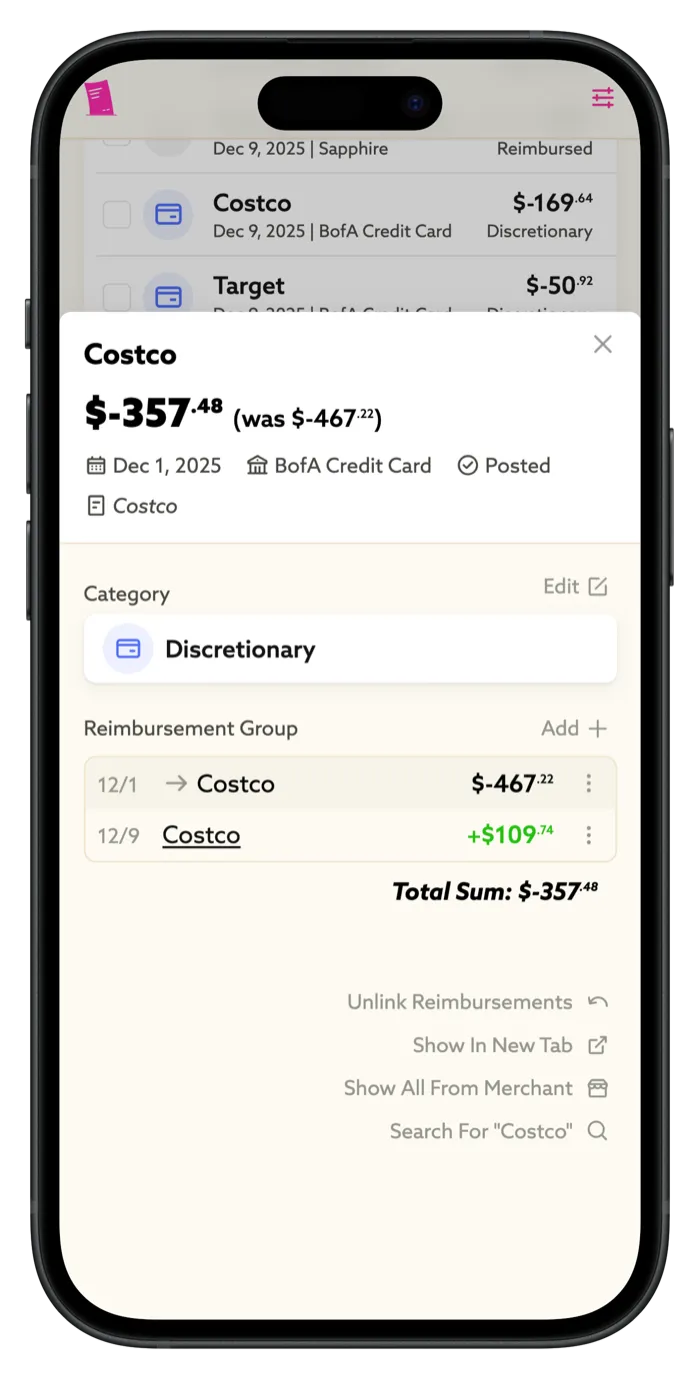

Smart Reimbursement Linking

Link reimbursements to their original purchases to adjust the amount and not skew your spending reports. Always remember to get paid back.

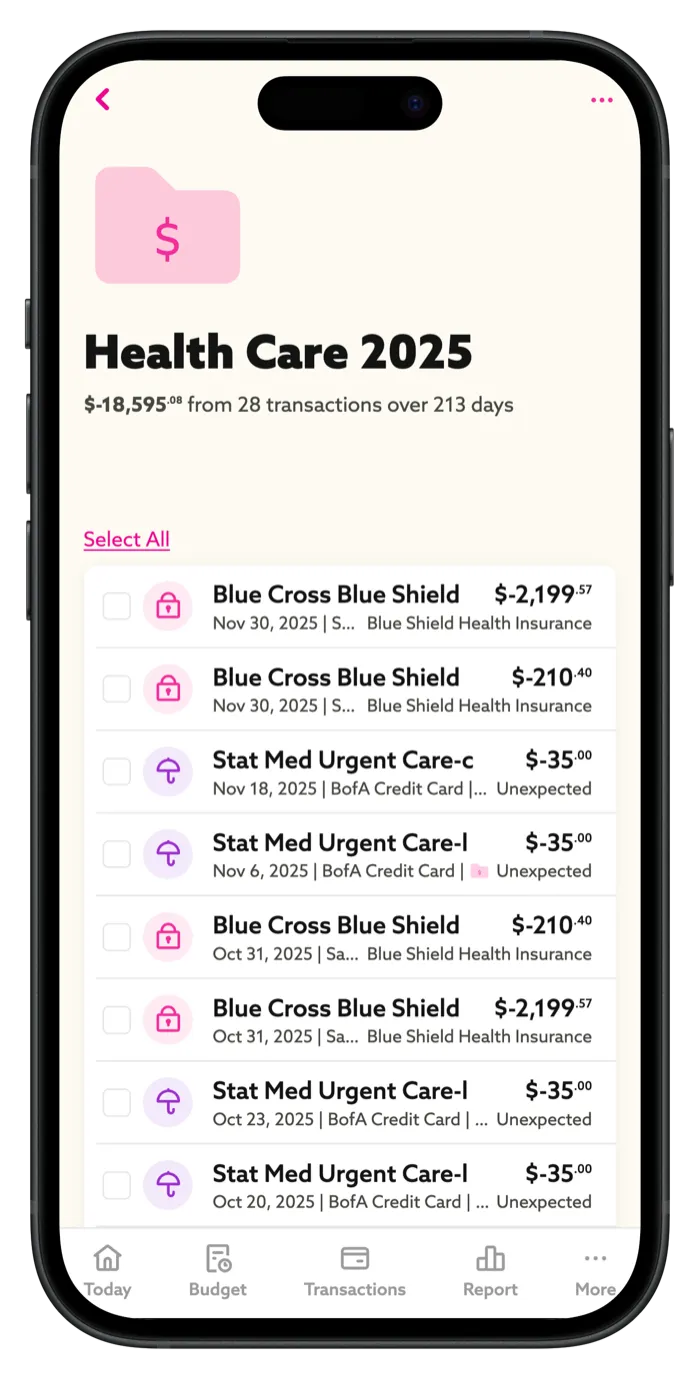

Transaction Albums

Organize transactions into albums to see the total cost of a vacation or home project.

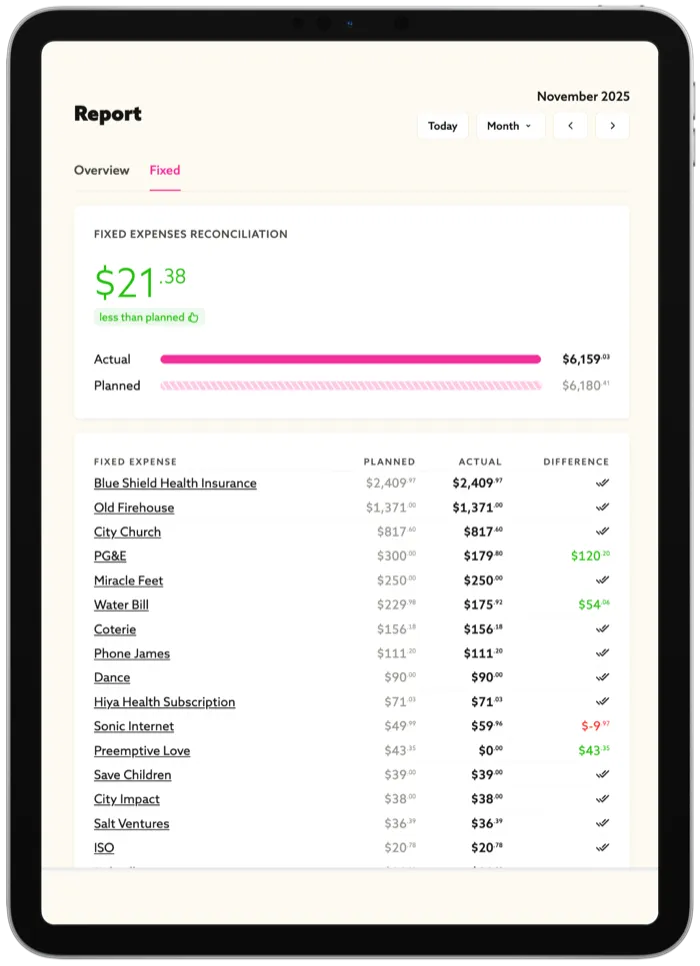

Fixed Expense Reconciliation

Easily match your planned fixed expenses with actual transactions, keeping your calendar accurate.