Three Happy Money Memories (And What They Taught Me)

By James Kerr on

My earliest memory of money is in 1995 just before Christmas. I was in kindergarten and my school set up a “Santa’s Workshop” marketplace with ornaments and decorations on sale for the kids to buy and give to their families. Each item cost between $1 and $3, and the gift wrapping station charged 50¢ per gift. My parents sent me to school that day with ten, one-dollar bills. I remember carefully considering which gifts I could afford so that each person in my family would receive one. I would buy something, then walk over to get it wrapped, then buy another, like any sensible 5-year-old. When I went home, I had no money and a brown paper bag filled with wrapped gifts for the people I loved. Those remain my most joyous transactions to date.

In my next memory, I am around 10. The bus was driving us home from a week of summer camp in the mountains and we stopped half-way for lunch at a McDonalds. The leaders gave each of us $7 to spend as we pleased. Again, I consciously selected items from the menu and transformed my $7 into french fries, a cheeseburger, and an Oreo McFlurry.

The next one also involves fast food. I was 19, independent for the first time, and very hungry. I tapped the banking app to view my checking account balance and discovered that I had $4. I then proudly walked into Del Taco and bought a single Crunchwrap Supreme for $3.20 with tax. It was the best Crunchwrap I’ve ever had and I saved that receipt as a memento.

Now I’m 34. I have joint checking account with my wife. We have 3 credit cards we use for spending, 2 kids in pre-school, and 50 other fixed expenses that get charged on varying schedules throughout the year. Spending money has lost the magical satisfaction it had when I was a child. How can I get it back?

I’ve found two things to be true about all my happy money moments.

- I knew exactly how much I could spend

- I consciously spent it on things I valued

As a child, knowing how much I could spend was simple: whatever the adult gave to me. Today it is more complicated. I must consider a checking balance, a few credit card balances, and any upcoming expenses. It’s not rocket science, but it's too hard for mental math. The not-knowing how much I can spend has led me to anxiousness and unconscious spending.

When I was 18, I discovered the joy of Excel. I tracked every purchase, even that Crunchwrap Supreme. I had charts, categories, totals, averages; it took effort, but it gave me peace.

As my spending increased over the years, I was relieved to find Mint. For much less effort, I was able to feel the same assurance that I was spending less than I earned. I still miss those beautiful green bars charting my “net worth” up and to the right.

Then I got married.

Sharing finances brought new complexity. The anxiety crept back in. The basics like “how much can we spend” became difficult to answer. But I’m a software developer and I know this to be true: computers are good at numbers!

I began trying out budget apps and landed on YNAB. I used it for years and even wrote my own plugin with their developer API to automate the tedious parts. But in the end, I cancelled my subscription because it required more effort than I could give and didn't show me the numbers I needed.

Again, I was flying blind.

One night, while reading a book, I glanced over the word “tend”. I thought, huh, that would be a great name for money software. Tend to your finances, legal tender, see how we tend to spend. That night I bought the domain. Two years later, you’re here – on the website.

I built Tend to answer the two simple questions:

- How much can I spend?

- Where did I spend it?

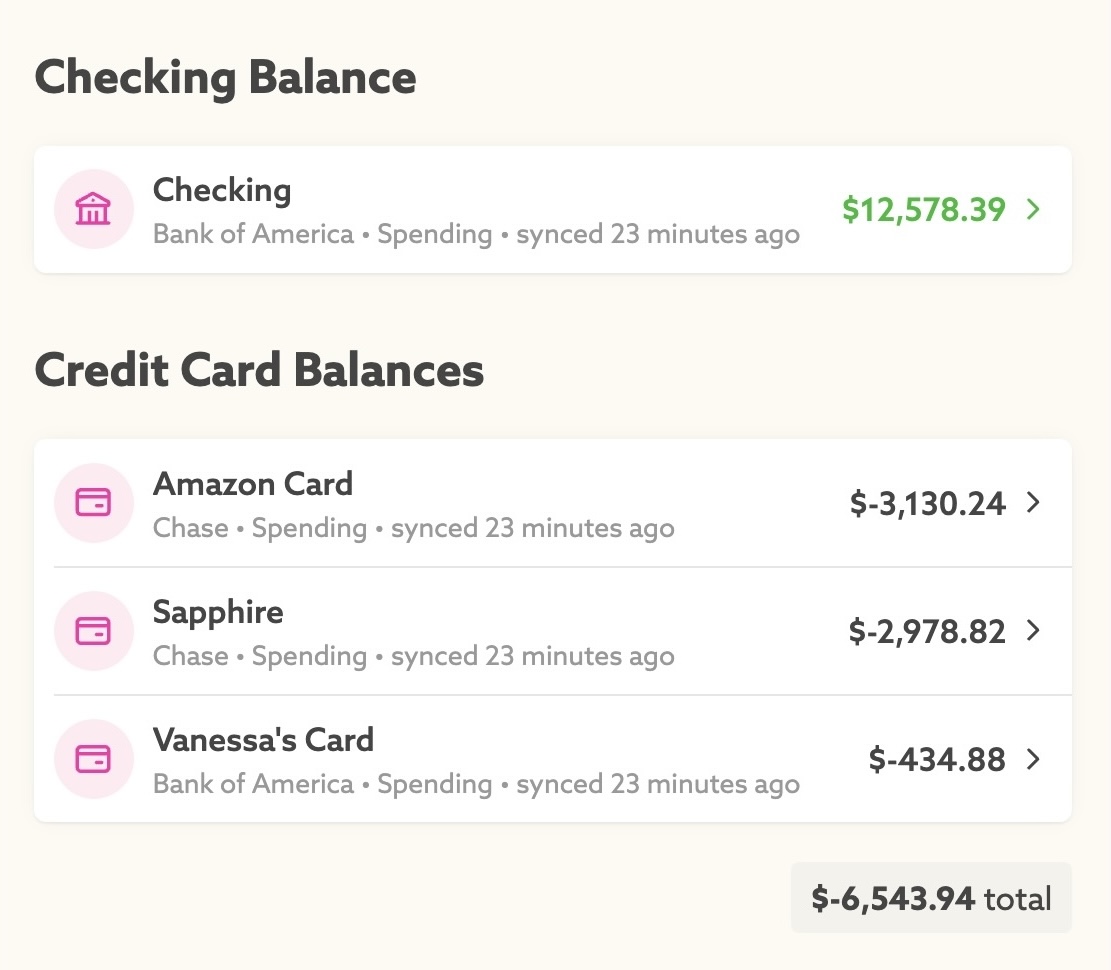

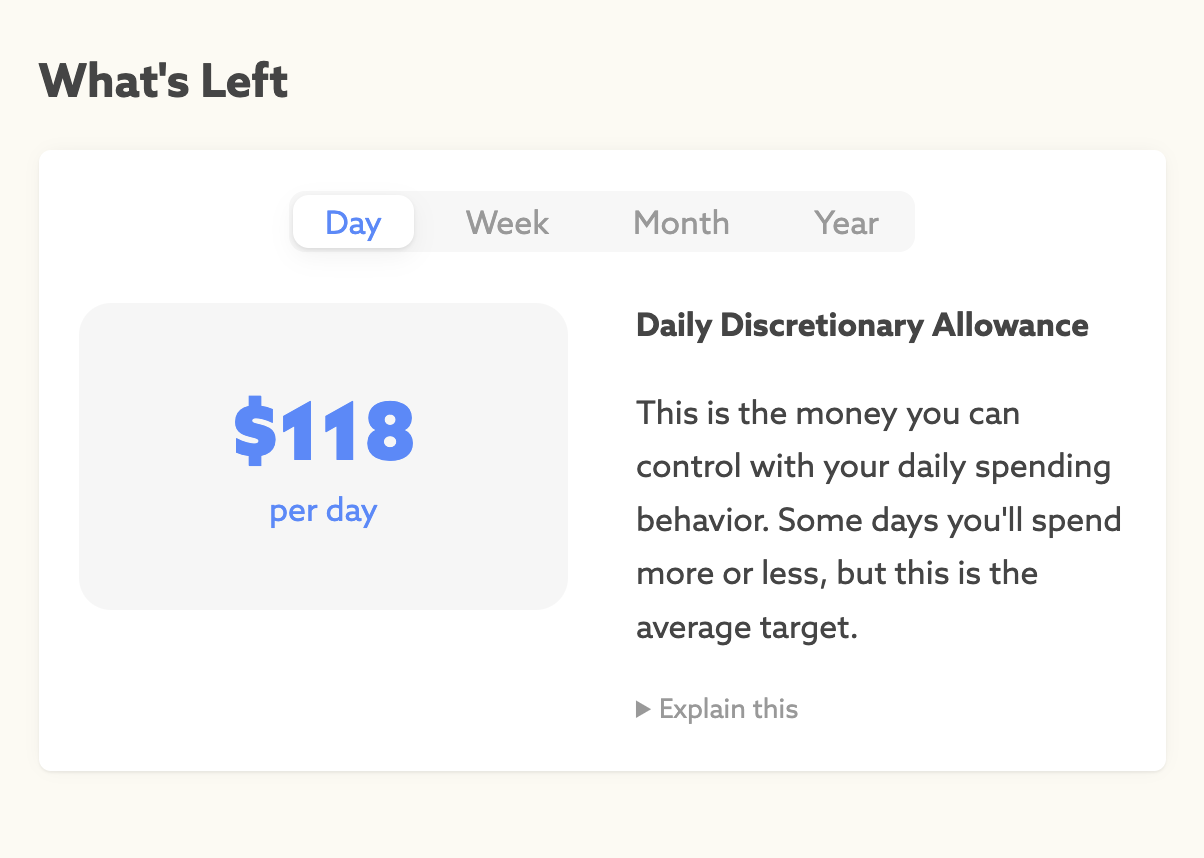

The obvious place to start is with my current account balances. Here's a screenshot from the Tend "today" page.

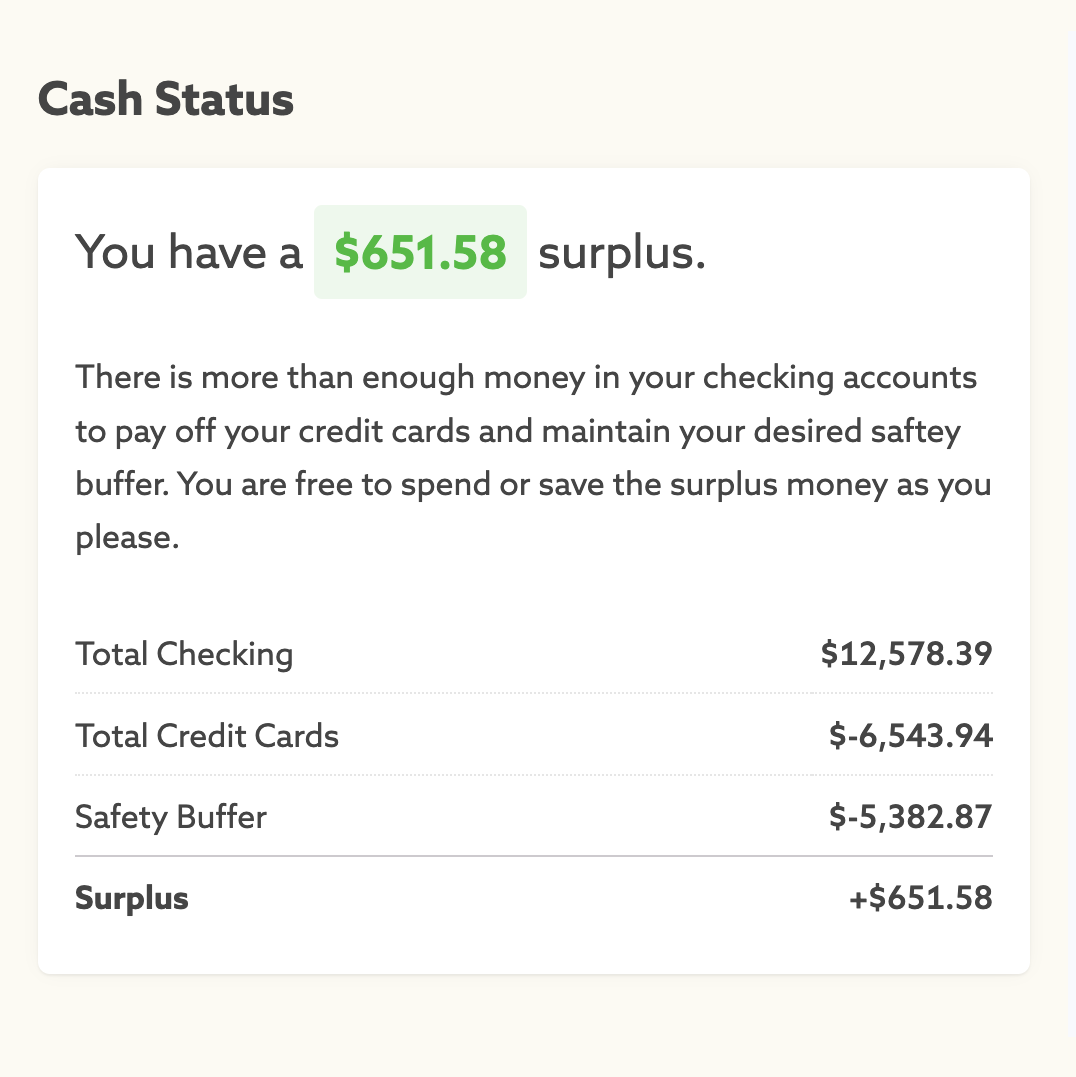

But let's take it a step further and determine your available surplus cash using this simple formula:

checking account - credit card balances - safety buffer = surplus cash

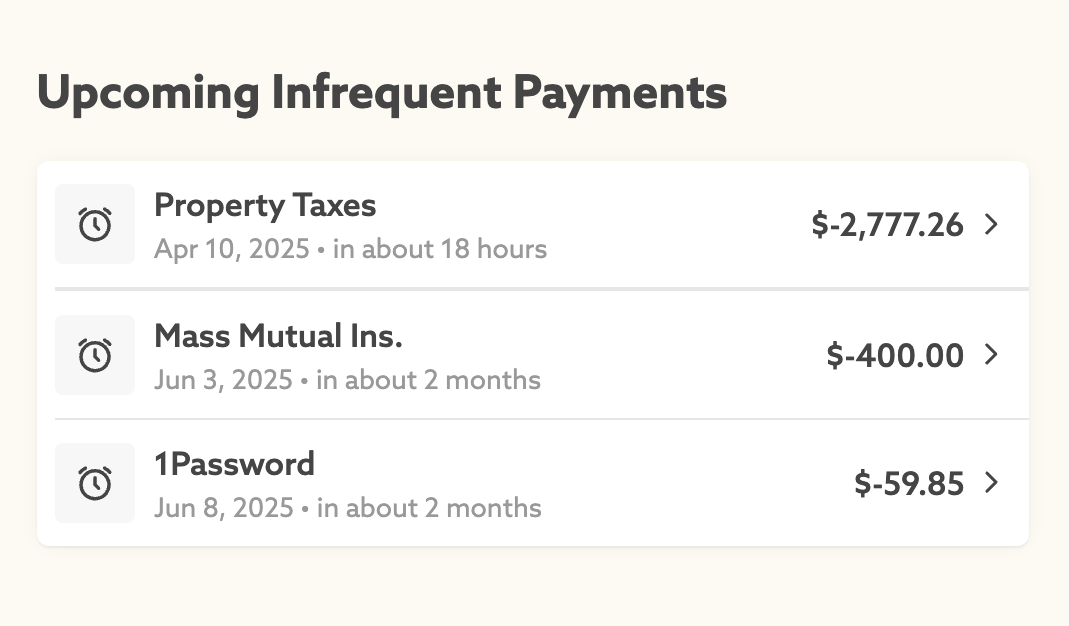

You instantly know if you can pay off your credit cards or if your safety buffer needs a little more cushion. It also keeps track of scheduled fixed expenses just like a repeating event on a calendar. You’ll never be caught off guard by those big annual bills.

Most other budget apps use a system called “zero-based budgeting”. They make you decide ahead of time all the ways you will spend your money. This much for rent, that much for coffee, clothes, Netflix, restaurants, personal hygiene…the category lists can get huge.

But I’ve learned first hand this approach suffers from an unfortunate reality: humans are terrible at predicting the future.

When you inevitably miss your spending marks, you “move” money around from category to category every month until you burn out and give up.

In Tend, there are only two categories:

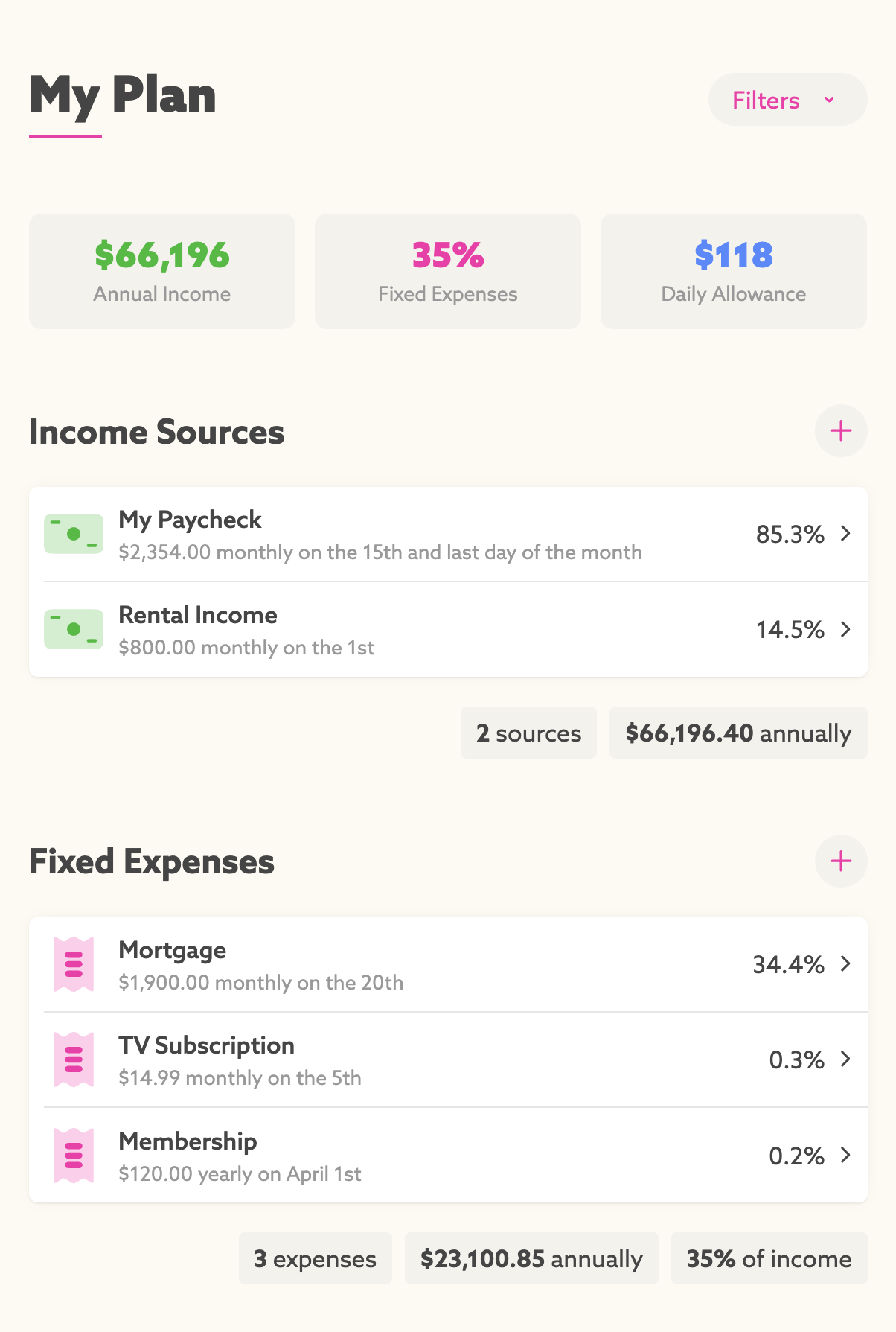

- Fixed expense: a known amount you’ve already committed to paying for on a set schedule

- Discretionary expense: pretty much everything else

Fixed income and expenses are predictable — we know exactly how much and when they occur. Tend allows you to input them exactly as they occur in real life.

We then reveal the amount you can spend on discretionary expenses with this simple formula:

total income - total fixed expenses = available for discretionary purchases

You control that discretionary amount. Tend won’t make you guess how you’ll spend it — but it will show where you spent it.

Last week I quit my job to work on Tend full-time. It’s live today and ready for you to try for free.

I want Tend to help us spend in ways that feel conscious, joyful, and worth-remembering — the way 5-year-old me felt, walking home with his bag of gifts.