About Tend

My first experience with money was when I was 5 years old. My elementary

school set up a holiday gift sale where I could use real money to buy

ornaments and decorations as gifts for my family.

My first experience with money was when I was 5 years old. My elementary

school set up a holiday gift sale where I could use real money to buy

ornaments and decorations as gifts for my family.

I showed up that morning with ten one-dollar bills in hand. I evaluated the items, calculated costs, made necessary compromises, and went home feeling fulfilled and excited for Christmas.

The goal of Tend Cash is to make our spending feel like that again.

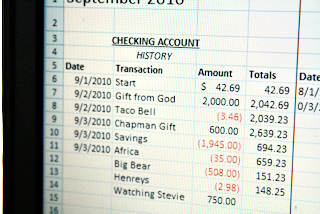

I've been tracking my money ever since I got a debit card at age 17. I manually typed each purchase into the spreadsheet. I loved it. This was back when online banking was new and cool.

Then Mint (RIP) launched and I hesitantly signed up (it was the first time I

gave my banking credentials to a third-party). But I never looked back. My

transactions automatically synced, the change in my net worth was easy to

see, and all my balances were in one place. Incredible.

Then Mint (RIP) launched and I hesitantly signed up (it was the first time I

gave my banking credentials to a third-party). But I never looked back. My

transactions automatically synced, the change in my net worth was easy to

see, and all my balances were in one place. Incredible.

When my wife and I got married, I looked for a way to budget our newly shared finances. We chose YNAB. We gave every dollar a job. It worked! For a time. Eventually the maintenance burden became too heavy and I burned out.

Then we were in the dark, relying only on checking account balances and intuition.

Every now and then I would burn a whole Sunday trying to track how we were doing financially. Now I'm pretty good on a computer, so if this was hard for me, I had to believe many others were in the same boat. That's when the idea for Tend sparked.

I did my undergrad part-time for 8 years, switching my major from film production to accounting, and finally to computer information systems. All the while I was working for the university on their website team. After graduation, I moved to San Francisco and spent 9 years working at 2 startups. In that time I got married, had three kids, and moved to the suburbs.

I started building Tend Cash part-time at the end of 2023. In April of 2025

I committed to it, leaving my job and bootstrapping the remaining

development with my own savings.

I started building Tend Cash part-time at the end of 2023. In April of 2025

I committed to it, leaving my job and bootstrapping the remaining

development with my own savings.

Today I, myself, use Tend to manage my own household finances and I'm happy to say it's working. My wife and I are aligned with our spending and saving like never before.

As I write this, Tend is a team of one. This means costs are low compared to our competition and I can give much of that margin to you. I haven't taken any outside investment, so I won't be forced to grow faster than necessary. All the money needed to run the company comes from your paid subscription. I can and do promise to never sell or share any of your personal data.

This is the best job I've ever had in the domain I feel most passionate about. It seems this is my task in life: to solve personal finance for modern, everyday people. I'm putting everything I've got into making Tend Cash that solution for us all.

- James

Founder